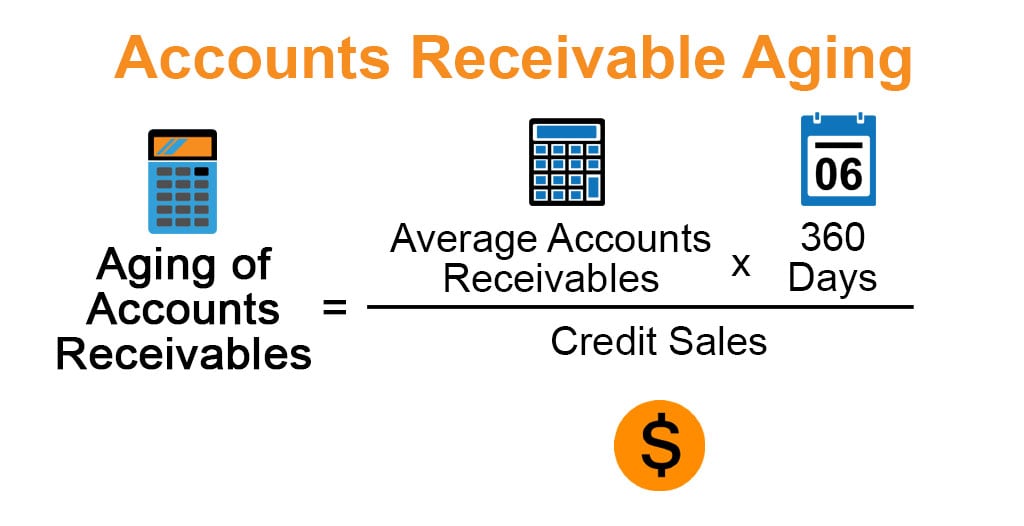

Accounts receivables aging is the time period from when sales are realized, and accounts receivables are created to the balance sheet. The typical column headers include 30-day windows of time, and the rows represent the receivables of each customer. Aging schedules are often used by managers and analysts to assess a business’s operational and financial performance.

Get in Touch With a Financial Advisor

It may need to borrow money to stay afloat because of the unpaid accounts. That will affect the company’s bottom line even further because it will be responsible for paying interest on the money it borrows. Every day a payment is overdue will have some sort of impact on a company’s financial position, and every account that is late how to file a business tax extension online 2020 multiples that impact. First, you’ll need to collect and organize all outstanding invoices from your accounts receivable. This means any invoices with a balance, even if it’s just a partial balance. To determine the amount of uncollectible accounts, an aging method is used for a collection system that is divided into time periods.

How is the balance in the allowance account determined at year-end under the aging method?

It’s a breakdown of receivables by the age of the outstanding invoice, along with the customer name and amount due. No matter what industry you’re in, keeping track of unpaid invoices is an essential part of maintaining a healthy cash flow. An accounts receivable aging report is a financial reporting tool that does just that, letting you see unpaid invoice balances, along with the duration for which they’ve been outstanding. With accounting software, you’ll be able to generate accounts receivable aging reports.

Calculate the Number of Days Past Due

The aging method is used because it helps managers analyze individual accounts. This provides information which can be used to determine whether any further collection efforts are justified or not. The aging method also makes it easier for management to make changes in credit policies and discounts offered to customers. To compute this allowance, analyze historical data and trends, apply percentages to each category in your accounts receivable aging report, and capture the potential loss for each segment. This method not only reflects realistic financial conditions but also ensures you are prepared for future uncertainties.

- The aging method only takes into account accounts that are considered by management to be uncollectible.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- An aging report lists a company’s outstanding customer invoices and payment due dates.

- Typically, the longer a debt goes uncollected, the higher the chance it remains uncollected.

- Companies usually use previous A/R aging reports to determine the historical percentage of invoice dollar amounts for each date period that resulted in bad debts.

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

Aging schedules allow companies to stay on top of A/R in hopes of limiting doubtful accounts. To demonstrate the application of the aging method, we will use the data from the Porter Company. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

If you’re using one of the many available accounting software packages for billing and accounts receivable processing, check it first to see if it prepares the aging schedule automatically. Most accounting software packages will prepare an accounts receivable aging schedule at the touch of a button, but always check, and don’t forget to solicit your accountant’s advice. Managing accounts receivable aging also helps you spot potential cash flow issues and implement effective management techniques to address those issues. By tracking your accounts receivable aging, you can pinpoint how much is owed to your business and for how long. Policies might include specifying payment terms and interest charges on late payments. If your aging report shows a rise in overdue accounts, consider tightening terms or requiring more stringent credit checks.

Your aging schedule is simply the categories you choose to place aging accounts receivable into. An example of an aging schedule would be ‘Current,’ ‘1-30 days past due,’ ‘31-60 days past due,’ and so on. Your AR aging percentage should be as low as possible—10 to 15% is ideal, but this can differ from business to business. You can find this number by taking the total amount of accounts receivable overdue in each of the overdue buckets by the total amount of receivables outstanding. The aging schedule also identifies any recent changes or new problems in accounts receivable.

Aging is considered the most important information when analyzing accounts receivables with ages above an appropriate number of turnover days that will negatively affect a company’s operations. Cash flow is important to a business because many businesses fail due to negative cash flow. That’s why tracking the cash flow is a crucial element of maintaining a healthy and successful business. Besides their internal uses, aging schedules may also be used by creditors in evaluating whether to lend a company money.